SCOTUS ruling refers to the IRS notification to Bob Jones University that they are no longer eligible for tax exempt status.

- Type

- Government Document

- Source

- Supreme Court of the United States Non-LDS

- Hearsay

- Direct

- Reference

Bob Jones University v. Simon, 416 U.S. 725 (1974)

- Scribe/Publisher

- Supreme Court of the United States

- People

- Bob Jones University, Supreme Court of the United States

- Audience

- Reading Public

- Transcription

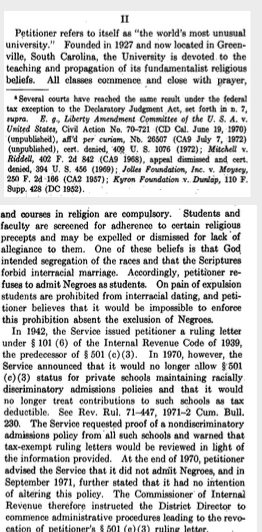

Petitioner refers to itself as "the world's most unusual university." Founded in 1927 and now located in Greenville, South Carolina, the University is devoted to the teaching and propagation of its fundamentalist religious beliefs. All classes commence and close with prayer, [416 U.S. 725, 735] and courses in religion are compulsory. Students and faculty are screened for adherence to certain religious precepts and may be expelled or dismissed for lack of allegiance to them. One of these beliefs is that God intended segregation of the races and that the Scriptures forbid interracial marriage. Accordingly, petitioner refuses to admit Negroes as students. On pain of expulsion students are prohibited from interracial dating, and petitioner believes that it would be impossible to enforce this prohibition absent the exclusion of Negroes. In 1942, the Service issued petitioner a ruling letter under 101 (6) of the Internal Revenue Code of 1939, the predecessor of 501 (c) (3). In 1970, however, the Service announced that it would no longer allow 501 (c) (3) status for private schools maintaining racially discriminatory admissions policies and that it would no longer treat contributions to such schools as tax deductible. See Rev. Rul. 71-447, 1971-2 Cum. Bull. 230. The Service requested proof of a nondiscriminatory admissions policy from all such schools and warned that tax-exempt ruling letters would be reviewed in light of the information provided. At the end of 1970, petitioner advised the Service that it did not admit Negroes, and in September 1971, further stated that it had no intention of altering this policy. The Commissioner of Internal Revenue therefore instructed the District Director to commence administrative procedures leading to the revocation of petitioner's 501 (c) (3) ruling letter.

- Source Link

- https://web.archive.org/web/20151001115949/https://caselaw.findlaw.com/us-supreme-court/416/725.html

- BHR Staff Commentary

The B. H. Roberts Foundation is not owned by, operated by, or affiliated with the Church of Jesus Christ of Latter-day Saints.