Kirtland Safety Society

What was the Kirtland Safety Society?

The Kirtland Safety Society Anti-Banking Company,[1] known as the Kirtland Safety Society, was a financial institution established by Church leaders in 1836.[2][3] It failed in 1837.[4]

The Kirtland Safety Society was initially intended to be a bank,[5] but, because it was unable to secure an Ohio charter,[6] it was reorganized as an "anti-banking" society.[7][8] It issued stock certificates[9] and Kirtland Safety Society notes (essentially a currency)[10] and accepted deposits.[11]

Timeline of the Kirtland Safety Society

January 27, 1816

The General Assembly of Ohio passes "An Act to prohibit the issuing and circulating of unauthorized Bank paper."[12]

January 24, 1824

The General Assembly of Ohio passes "An Act, to regulate judicial proceedings where banks and bankers are parties, and to prohibit issuing bank bills of certain descriptions."[13]

September 11, 1831

March 27, 1836

August 6, 1836

Joseph Smith receives a revelation promising that the Church will be relieved of its debts.[18]

August 3, 1836

September 12 or 13, 1836

October 5, 1836

November 2, 1836

Joseph Smith reports the official establishment of the "Kirtland Safety Society."[23]

December 1836

The Constitution of the Kirtland Safety Society Bank (November 2, 1836) is published in the Latter-day Saint periodical Messenger and Advocate.[24]

1837

The Financial Panic of 1837 in the United States results in many financial institutions closing down.[25]

January 1837

The "Articles of Agreement for the Kirtland Safety Society Anti-Banking Company" are published.[26]

January 6, 1837

February 9, 1837

April 6, 1837

Wilford Woodruff records Joseph and Hyrum teaching that Kirtland would become a center of commerce where "kings of the earth would come to behold the glory thereof."[29]

May 29, 1837

June 1, 1837

July 1837

Joseph Smith records his resignation from his office in the Kirtland Safety Society and reports that it was unsuccessful due to "darkness, speculation, and wickedness."[33]

August 1837

In the Messenger and Advocate, Joseph Smith warns members about speculators who are "palming upon them" now-worthless bills from the Kirtland Safety Society.[34]

September 3, 1837

October 24, 1837

Joseph and Sidney are tried in absentia on the charges brought by Grandison Newell.[37]

November 1837

The Kirtland Safety Society ceases all operations.[38]

January 1, 1838

Joseph Smith and Sidney Rigdon, citing a "spirit of apostate mobocracy," flee Kirtland.[39]

February 5, 1838

March 1, 1838

August 1838

In the August 1838 issue of the Elders' Journal, Joseph accuses Warren Parrish of embezzling funds from the Kirtland Safety Society.[43]

So why did the Church start a bank?

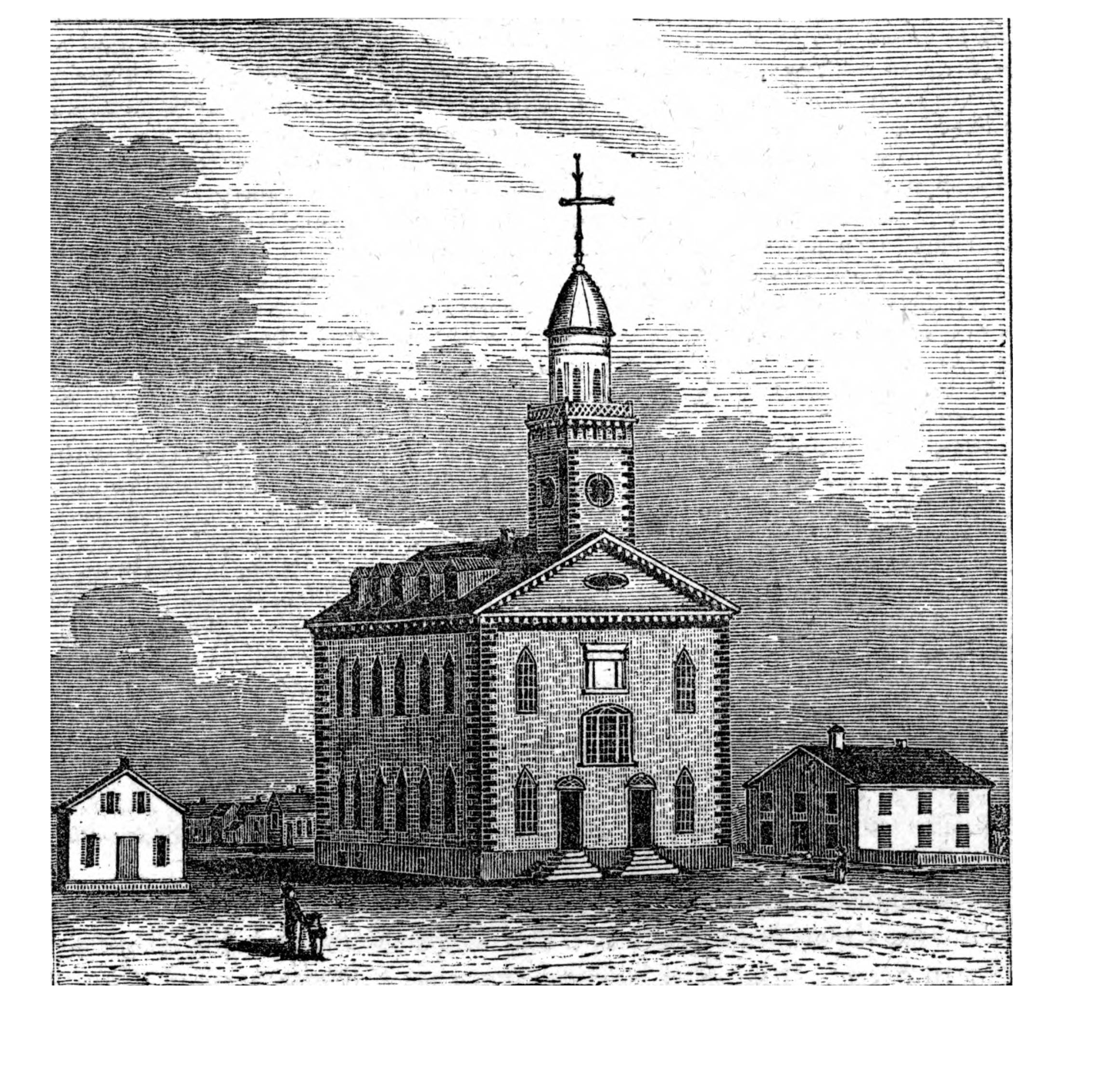

One primary reason was the Church's financial troubles due to debt from land purchases and building projects,[44][45] including the Kirtland Temple, which likely cost an estimated $30,000[46] to $40,000[47] in the 1830s (approximately $1.3 million in 2024[48]).[49] Joseph was reportedly the one who initially conceived the idea for the bank.[50]

Why would the early Church leaders address a debt crisis by opening a bank?

The bank was intended to issue currency, provide loans, and stimulate local business.[51] One way they could do this through the Kirtland Safety Society was by using assets that normally cannot be easily turned into cash (for example, land) as collateral for loans and providing money for purchases.[52]

Was it common to set up a financial institution in America at the time?

Yes. In Ohio, at the time, many businesses were issuing banknotes and performing other "bank-like" activities, even if they were not banking institutions themselves.[53][54] The Ohio General Assembly issued acts in 1816[55] and 1824[56] that restricted newly established institutions from issuing banknotes, creating legal barriers that complicated the operation of unchartered banks.[57]

But was it normal for a church to start a bank at the time?

No, not really. While Protestants established some banks in Europe,[58] this was not a typical practice in America. The closest example in the nineteenth-century United States may have been a limited liability joint stock company that a part of the Oneida Community[BIO] proposed in 1880 but never established.[59]

Why was the Kirtland Safety Society sometimes called an "Anti-Banking" society?

The Kirtland Safety Society was initially intended to be a bank,[60] but, because it was unable to secure an Ohio charter,[61] it was reorganized as an "anti-banking" society.[62] The term "anti-banking" did not mean that they were against banking, but rather, it was a term to make it clear that they were not a state-chartered institution.[63]

Was the Kirtland Safety Society legal?

No, not as originally conceived. The Kirtland Safety Society was denied a bank charter, reportedly because the applicants were Mormons,[64][65] but this may not be the case as there was only one charter approved between 1835–36.[66] In early January 1837, the society was reorganized and began operating as an "unauthorized bank," which was common in Ohio at the time.[67]

Then, because Ohio recognized the legitimacy of banking charters from other states,[68] Joseph Smith and others involved with the Kirtland Safety Society met with officials of the Bank of Monroe in Michigan in February 1837 to seek a merger to operate as a subsidiary of the Bank of Monroe.[69]

How was the Kirtland Safety Society financed?

Beginning in October 1836, funds were raised by selling stock in the Kirtland Safety Society.[70] It is also likely that land purchased in the Kirtland area by Joseph Smith and other Church leaders in September and October 1836 served as security for the bank.[71]

Wasn't the initial capital stock for the Kirtland Safety Society set at an extravagant amount?

Probably.[72] The initial capital stock for the Kirtland Safety Society was set at $4 million,[73] whereas community banks of the time are reported to have been typically capitalized with $100,000 to $300,000.[74][75]

Related Question

Do prophets make mistakes?

Read more in Prophetic Fallibility

Did Joseph Smith prophesy that the Kirtland Safety Society would be a success?

Joseph said "all would be well" with the Kirtland Safety society upon the condition that the Saints "would give heed to the commandments the Lord had given."[76]

However, some Church members believed this meant the bank would never fail because it was "instituted by the will of God."[77]

Why did the Kirtland Safety Society fail?

There are several reasons, from economic to social (see table below).

Reason | Details |

The Financial Panic of 1837 in the United States. | As a result of the economic downturn in 1837,[78] financial institutions, including the Kirtland Safety Society, faced bank runs and an inability to redeem issued bills.[79][80] |

The underfunding of the Kirtland Safety Society. | The Kirtland Safety Society was underfunded due to the small amount stockholders could pay.[81] |

The activities of Grandison Newell. | Grandison Newell engaged in concerted attacks on the Kirtland Safety Society by purchasing as many of the Kirtland Safety Society notes as he could and then redeeming them all at once for specie (hard currency), resulting in the liquid assets of the Kirtland Safety Society being diminished.[82] |

Rumors that the Safety Society was illiquid. | There were rumors that the bank's vaults were empty and its officers were refusing to exchange banknotes for hard currency.[83] |

Financial speculation among Church members.[84] | Joseph Smith believed that some Church members were engaged in speculation, which was one factor in the institution's failure.[85] Joseph himself was criticized for allegedly engaging in speculation.[86] |

Insufficient reserves. | The bank lacked adequate specie (gold and silver) reserves to back its currency, which was a common problem for many banks of that era.[87] |

Inexperienced leadership. | Joseph Smith and other church leaders had little to no experience in banking or finance.[88] |

What happened when the bank failed?

After the bank stopped operations, some of the deposits were returned to investors in the Kirtland Safety Society,[89] while others were lost.[90] The Church and Joseph also incurred debts.[91]

Did Joseph Smith personally make any money from the Kirtland Safety Society?

No. Joseph Smith had the greatest losses of any individual from the collapse of the Kirtland Bank, having accumulated large amounts of debt from establishing and running the Safety Society, purchasing land in Kirtland, and buying inventory for his store.[92]

Is it true that Joseph Smith filled boxes in the Kirtland Safety Society with lead, rocks, and sand?

No, probably not. One critic claimed that Joseph filled the safe of the Kirtland Safety Society with 100–200 boxes marked "$1,000" filled with lead, rocks, and sand to give the impression the bank had gold and silver reserves.[93] However, there was no vault to store that many boxes, and the dimensions of the safe used do not seem to support it containing 100-200 such boxes.[94]

Is it true that Joseph Smith was taken to court after the failure of the Kirtland Safety Society?

Yes. On February 9, 1837, Samuel Rounds, acting on behalf of Grandison Newell, brought charges against Joseph Smith and the others for issuing banknotes without a charter.[95][96] On October 24, 1837, Joseph and Sidney Rigdon were tried, and Justice Samuel Rounds would charge Joseph a total of $1,024.10.[97] On March 1, 1838, the cost of the legal judgments against Joseph Smith and Sidney Rigdon was assigned to their agents, William Marks and Oliver Granger, with the cost totaling $1,600.[98]

Did Joseph con a bunch of people into supporting this bank and then punish or kick out anyone who didn't agree?

Probably not. Dissension within the Church coincided with the period of the Kirtland bank and a general economic downturn in the United States.[99][100] During this time, various Church leaders such as Parley P. Pratt,[101] Orson Pratt and Lyman E. Johnson,[102] and Warren Parrish[103] publicly criticized Joseph. Johnson and Parrish were eventually excommunicated,[104] but both Orson and Parley Pratt would later seek forgiveness from Joseph for apostasy in July 1837.[105]

Did the failure of the Kirtland Safety Society push Joseph Smith to leave Kirtland?

Yes, in some ways. The difficulties of the Kirtland Society were compounded by legal issues[106] and threats of violence against Joseph Smith and other Church leaders,[107] making it increasingly untenable for them to remain in Kirtland safely. In early 1838, Joseph Smith and Sidney Rigdon left Kirtland and moved to Far West, Missouri.[108]

- Jace

“I remember originally learning about this bank or anti bank and being a bit unsettled. We are so accustomed to highly regulated banking today that it seems odd but, when you look at what was happening at this period of history it made sense that they came up with this idea.”

about this topic

about this topic