IRS Website lists organizations (e.g., an integrated auxiliary of a church) that are exempt from federal income tax under Internal Revenue Code section 501(a).

- Type

- Website

- Source

- IRS Non-LDS

- Hearsay

- Direct

- Reference

"Annual Exempt Organization Return: Who Must File," Internal Revenue Service, 2023, accessed September 26, 2023

- Scribe/Publisher

- IRS

- People

- IRS

- Audience

- Reading Public

- Transcription

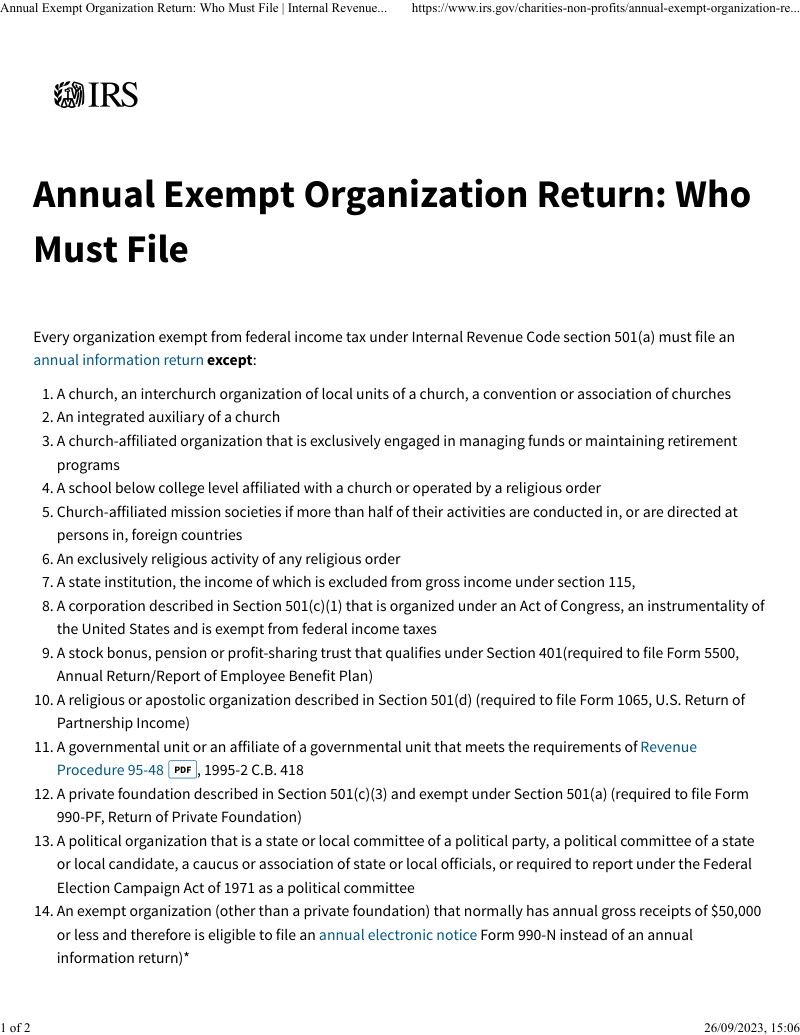

Every organization exempt from federal income tax under Internal Revenue Code section 501(a) must file an annual information return except:

A church, an interchurch organization of local units of a church, a convention or association of churches

An integrated auxiliary of a church

A church-affiliated organization that is exclusively engaged in managing funds or maintaining retirement programs

A school below college level affiliated with a church or operated by a religious order

Church-affiliated mission societies if more than half of their activities are conducted in, or are directed at persons in, foreign countries

An exclusively religious activity of any religious order

A state institution, the income of which is excluded from gross income under section 115,

A corporation described in Section 501(c)(1) that is organized under an Act of Congress, an instrumentality of the United States and is exempt from federal income taxes

A stock bonus, pension or profit-sharing trust that qualifies under Section 401(required to file Form 5500, Annual Return/Report of Employee Benefit Plan)

A religious or apostolic organization described in Section 501(d) (required to file Form 1065, U.S. Return of Partnership Income)

A governmental unit or an affiliate of a governmental unit that meets the requirements of Revenue Procedure 95-48PDF, 1995-2 C.B. 418

A private foundation described in Section 501(c)(3) and exempt under Section 501(a) (required to file Form 990-PF, Return of Private Foundation)

A political organization that is a state or local committee of a political party, a political committee of a state or local candidate, a caucus or association of state or local officials, or required to report under the Federal Election Campaign Act of 1971 as a political committee

An exempt organization (other than a private foundation) that normally has annual gross receipts of $50,000 or less and therefore is eligible to file an annual electronic notice Form 990-N instead of an annual information return)*

A foreign organization, or an organization located in a U.S. possession, that normally has annual gross receipts from sources within the United States of $50,000 or less and therefore is eligible to file an annual electronic notice (Form 990-N instead of an annual information return)

Note: A Section 509(a)(3) supporting organization must generally file Form 990 or 990-EZ. The exceptions listed above are not available to a supporting organization unless it is an integrated auxiliary of a church (No. 2 above) or an exclusively religious activity of a religious order (No. 6).

Additional information

Requesting Exemption from Requirement to File Form 990 or Form 990-EZ

www.stayexempt.irs.gov/workshop - Interactive Training for Charities

- Citations in Mormonr Qnas

The B. H. Roberts Foundation is not owned by, operated by, or affiliated with the Church of Jesus Christ of Latter-day Saints.