IRS Website discusses the function of Form 990.

- Type

- Government Document

- Source

- IRS Non-LDS

- Hearsay

- Direct

- Reference

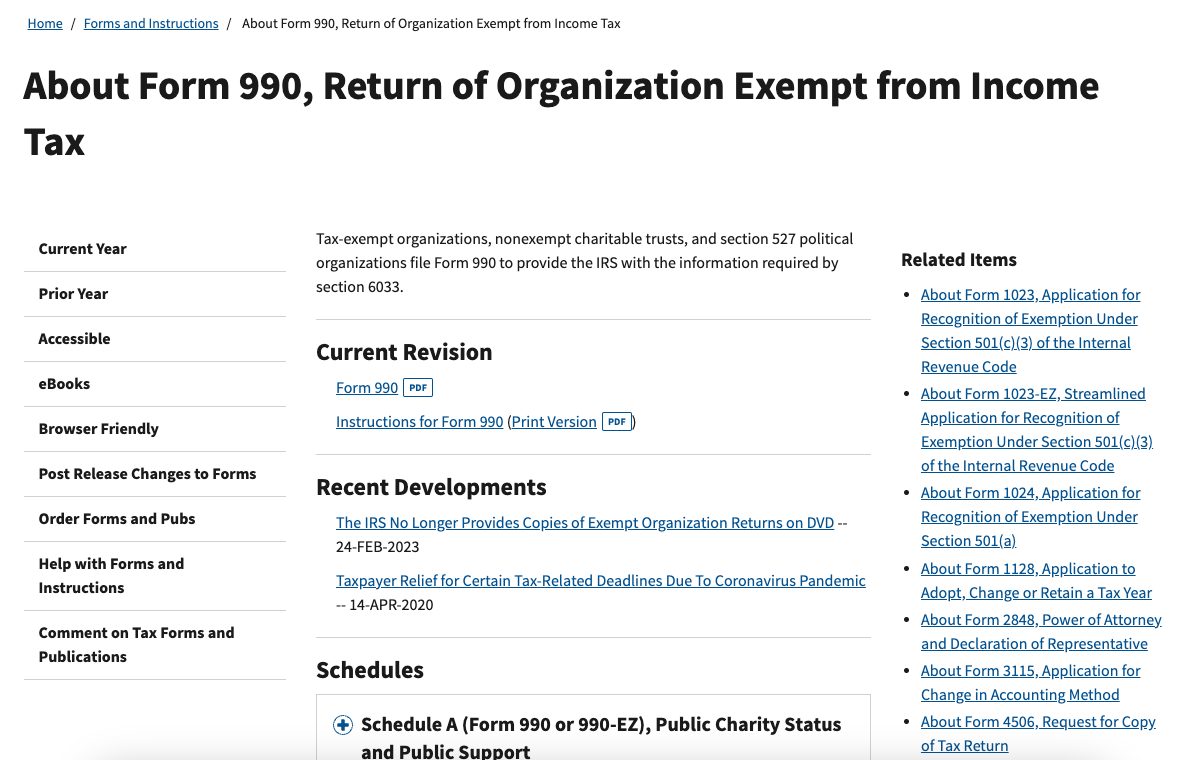

"About Form 990, Return of Organization Exempt from Income Tax," IRS, accessed April 1, 2023

- Scribe/Publisher

- IRS, Department of the Treasury

- People

- IRS

- Audience

- Internet Public

- Transcription

Current Year

Prior Year

Accessible

eBooks

Browser Friendly

Post Release Changes to Forms

Order Forms and Pubs

Help with Forms and Instructions

Comment on Tax Forms and Publications

Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file Form 990 to provide the IRS with the information required by section 6033.

Current Revision

Form 990PDF

Instructions for Form 990 (Print VersionPDF)

Recent Developments

The IRS No Longer Provides Copies of Exempt Organization Returns on DVD -- 24-FEB-2023

Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic -- 14-APR-2020

Schedules

Use tab to go to the next focusable element

Schedule A (Form 990 or 990-EZ), Public Charity Status and Public Support

Schedule B (Form 990, 990-EZ, 990-PF), Schedule of Contributors

Schedule C (Form 990 or 990-EZ), Political Campaign and Lobbying Activities

About Schedule D (Form 990), Supplemental Financial Statements

About Schedule E (Form 990 or 990-EZ), Schools

About Schedule F (Form 990), Statement of Activities Outside the United States

About Schedule G (Form 990 or 990-EZ), Supplemental Information Regarding Fundraising or Gaming Activities

About Schedule H (Form 990), Hospitals

About Schedule I (Form 990), Grants and Other Assistance to Organizations, Governments and Individuals in the U.S

About Schedule J (Form 990), Compensation Information

About Schedule K (Form 990), Supplemental Information on Tax-Exempt Bonds

About Schedule L (Form 990 or 990-EZ), Transactions with Interested Persons

About Schedule M (Form 990), Noncash Contributions

About Schedule N (Form 990 or 990-EZ), Liquidation, Termination, Dissolution, or Significant Disposition of Assets

About Schedule O (Form 990), Supplemental Information to Form 990 or 990-EZ

About Schedule R (Form 990), Related Organizations and Unrelated Partnerships

- Citations in Mormonr Qnas

The B. H. Roberts Foundation is not owned by, operated by, or affiliated with the Church of Jesus Christ of Latter-day Saints.