The $100 Billion Fund

Does the Church have a $100 billion fund?

Yes, although estimates as to the size of the fund vary from $38 billion to over $100 billion.[1] The fund is characterized by the Church as a "reserve fund"[2] managed by its investment arm,[3] Ensign Peak Advisors, Inc. (EPA).[4]

Why don't we know the exact size of the fund? Doesn't the Church have to disclose how much is in the fund?

No, not by law—most nonprofits are required to file information reports to the IRS, but this requirement does not apply to churches and their auxiliaries.[5] Church leaders and EPA managers do not publish details publicly about the reserve fund.[6]

If the Church doesn't have to disclose how much is in the fund, how do we know it's a "$100 billion fund"?

There are only two sources of information about the size of the fund[7]—one is from the SEC[8] and the other is from a former EPA employee David Nielsen[BIO] who left EPA and disassociated with the Church in 2019[9] and claimed that the EPA had wrongfully accumulated a "reserve of the reserves" of over $100 billion and contacted the IRS Whistleblower Office.[10][11]

Shortly after David Nielsen resigned, David's twin brother Lars contacted various media outlets,[12] including the Washington Post and Newsweek,[13] and since then, the "$100 Billion fund" has come up in the news from time to time.[14] See table below.

Table of Primary Sources about the Fund

Amount | Source | Publication |

$81.2 billion in 2018.[15] | David Nielsen | "Memorandum of David A. Nielsen submitted to the U.S. Senate Finance Committee and its Subcommittee on Taxation and IRS Oversight," 2023[16] |

$124 billion in 2019.[17] | David and Lars Nielsen | "Letter to an IRS Director," 2019[18] |

$37.8 billion in 2020.[19] | SEC Order | ADMINISTRATIVE PROCEEDING File No. 3-21306 In the Matter of ENSIGN PEAK ADVISORS, INC., and THE CHURCH OF JESUS CHRIST OF LATTER-DAY SAINTS, 2023[20] |

$44.4 billion in 2022.[21] | Filings to the SEC | 2022 Q4, Form 13F, filed with the SEC[22] |

Over $100 billion in 2023.[23] | David Nielsen | "Mormon Church Investment Fund Whistleblower," 60 Minutes, May 14, 2023[24] |

Key events in the history of the Church's reserve fund

Historic Financial Troubles

1880s

Anti-polygamy laws cripple Church finances by dissolving the Church's legal identity, confiscating Church assets, and blocking the Church's ability to secure loans.[25]

1893

The Panic of 1893 worsens the Church's financial situation and it accrues between one and two million dollars of debt and is unable to make its payroll.[26]

1907

1929-1939

April 1940

1959

The Church resumes borrowing money, primarily for building construction.[32]

1962-1963

Church reserves are depleted, having spent $32 million more than revenue, the Church has a cash-flow crisis and nears bankruptcy.[33]

October 4, 1963

The Modern Era of Church Finance

1995

1997

Ensign Peak Advisors, Inc., (EPA) is formed to manage Church investments and is given $7 billion of Church assets to start with.[39]

2001

2005

2009

EPA distributes approximately $600 million to "bailout" a for-profit insurance business owned by the Church, Beneficial Financial Group, that was in danger of failing due to the financial crisis in 2008-2009.[44]

2010-2014

Between 2010 and 2014, EPA distributes $1.4 billion to Property Reserve, Inc. for the construction of City Creek Center.[45]

2011

2015

May 2018

June 2019

The SEC notifies the Church that it is concerned with how it is filing its public disclosure forms across multiple LLCs. The Church responds by consolidating its filings into a single form through EPA.[54]

September 2019

David Nielsen leaves employment at EPA by mutual decision.[55]

Media Attention on the Church's Billions

November 21, 2019

The IRS Whistleblower Office receives a complaint from David and Lars Nielsen, which alleged that EPA had about $100 billion in nonprofit accounts; among the grievances listed include the charge that EPA made no religious, educational, or charitable distributions in 22 years and that EPA unlawfully distributed $1.4 billion towards a non-legitimate purpose as per EPA's AOI and per IRS rules.[56]

December 2019

2021

Former Latter-day Saint and film distributor James Huntsman[BIO] files a lawsuit against the Church for misuse of tithing funds.[59] David Nielsen testifies.[60] The suit is dismissed[61], but reinstated on appeal.[62] The lawsuit was later unanimously dismissed by the 9th Circuit Court of Appeals.[63]

January 31, 2023

David Nielsen submits a petition to the U.S. Senate Finance Committee and its Subcommittee on Taxation and IRS Oversight with an updated memorandum on EPA asking the federal government to "recover" $20 Billion in taxes.[64]

February 21, 2023

May 14, 2023

David Nielsen makes his first public interview about EPA's "$100 billion fund" on 60 Minutes on CBS.[68]

What does the Church need all this money for?

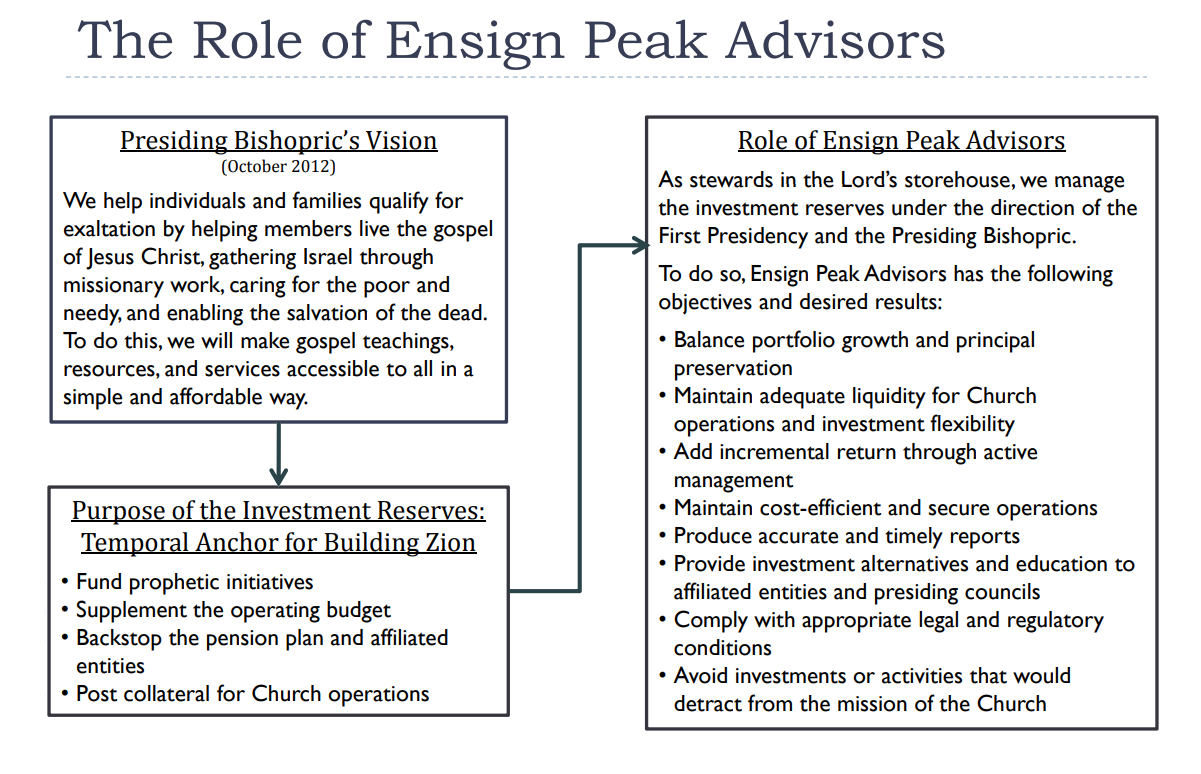

Church leaders refer to this money as a reserve meant to ensure the continued operation of the Church in case of a "rainy day"[69] or to "weather the storm"[70] of any future economic distress.[71] The Church states that "all church funds exist for no other reason than to support the church's divinely appointed mission"[72] and that it is "a sound doctrinal and financial principle taught by the Savior in the Parable of the Talents."[73]

Related Question

How much does a temple cost to build?

Read more in Cost of Temples

Is all this money in preparation for the Second Coming?

Probably not. Bishop Waddell said, "As a Christian church, we believe that someday Jesus Christ will return, but that’s not why we have those resources. It’s for the continued operation and for the future."[75]

David Nielsen claimed that the funds were for "the second coming"[76] but then clarified that "it’s a bit tongue and cheek, but deep down, I think a lot of the employees really did believe that."[77]

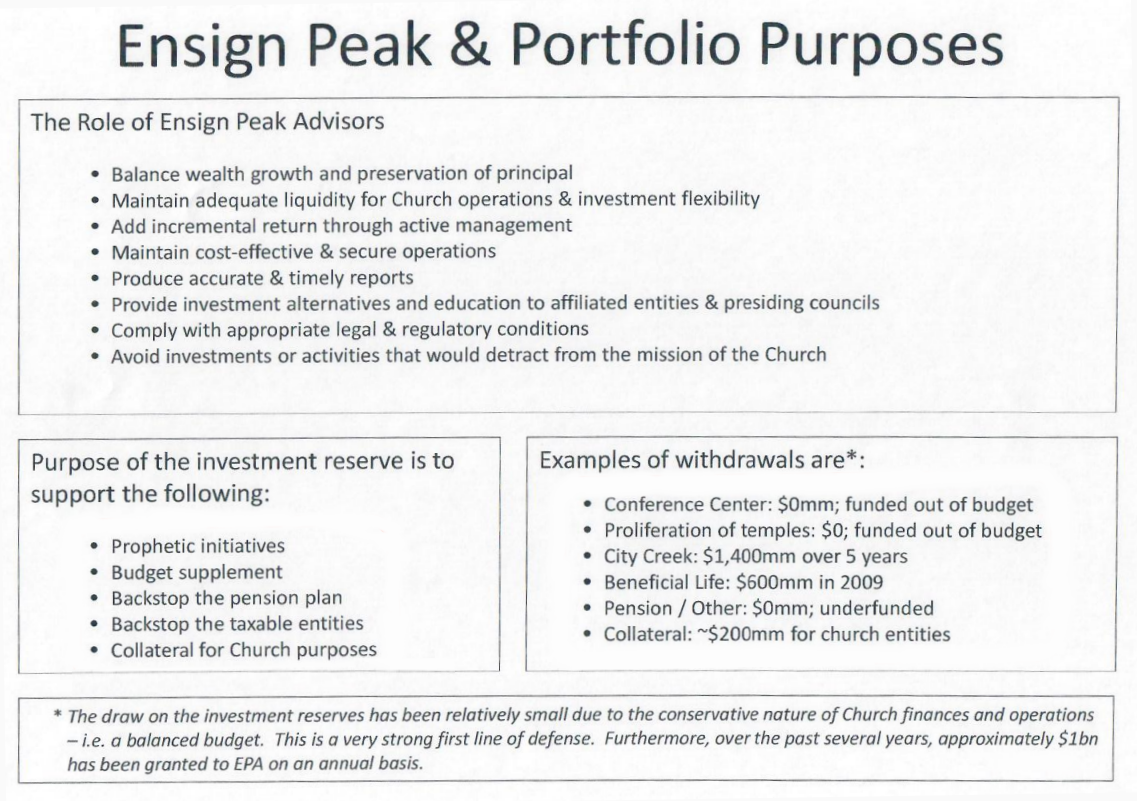

Does the Church spend any of this money or just stockpile it?

It seems as though it mostly just stockpiles the funds.[78] Bishop Waddell reported that EPA regularly dispenses money from EPA cash accounts back to the Church to fund church operations, humanitarian work, and other church work.[79] However, former EPA employee David Nielsen claimed those cash accounts are distinct from EPA's investments, which are stockpiled with minimal withdrawals.[80]

Reportedly, EPA distributed large amounts of money twice to Church-owned corporations[81]—$600 million in 2009 for a Church-owned life insurance group[82] and $1.4 billion between 2010 and 2014 for City Creek Mall.[83]

Related Question

Why did the Church build a mall?

Read more in The City Creek Mall

How does stockpiling money contribute to the Church's mission?

The Church describes the reserve fund as insurance so the Church's mission can continue despite financial hardships.[84] Reportedly, EPA refers internally to its investment reserves as a "Temporal Anchor for Building Zion" (see image below).[85] On 60 Minutes, Bishop Waddell described EPA's fund as "the Church's treasury," emphasizing the fund was for the Church's continued operation and the future, or "how many years' worth we have in case of financial difficulties, in case of financial crisis, to make sure that we can continue church operations."[86]

Is it immoral for the Church to save money while there are so many poor people in the world?

While the Church does commit significant funds to humanitarian aid,[87] some people think this is not enough in comparison to Church investments.[88] Others consider Church reserves to be reasonable[89] or good stewardship.[90]

Isn't $100 billion more than enough for a reserve?

Maybe. Some think the amount in the reserves is reasonable,[91] while others find it objectionable.[92]

A Church reserve of $100 billion dollars equates to about $5,900 per Church member.[93] It's been estimated that without tithing, the Church would run out of money after 16 years,[94] though others estimate that the Church could be run in perpetuity with its reserve.[95]

While the Church's reserve fund probably equals a little over 16 years of Church expenses,[96] nonprofits like Harvard and The Bill and Melinda Gates Foundation have funds that cover about ten years of their expenses.[97]

How much does the Church spend on humanitarian aid?

About a billion dollars a year,[98] though this was reportedly less in the past due to differences in how it was accounted for.[99] New humanitarian aide accounting includes humanitarian projects, fast offering assistance, Bishop's orders for goods, donated commodities and clothing, and church operations like counseling, employment centers, and food production.[100]

Couldn't they spend more?

Yes.

Is the Church doing anything illegal by having this fund?

No.[101][102] However, they did violate SEC reporting regulations in how they disclosed EPA's portfolio, were fined for it in 2023, and have changed their reporting to conform with the SEC's order.[103]

Really? If it's not illegal, why would someone "whistleblow"?

It's complicated. There are a number of tests the IRS uses to evaluate the tax-exempt status of nonprofits,[104] which include an organizational test,[105] an operational test,[106] a private inurement test,[107] a test for limitations on lobbying and political activity[108] and a "commensurate test."[109][110][111][112]

If someone believed that the Church wasn't carrying out sufficient charitable activity then disclosure to the IRS may be considered "blowing the whistle" on the Church. Additionally, if the IRS recovered money from the Church then the whistleblower may be awarded some percentage of the amount recovered, which may be a factor in motivating someone to "whistleblow."[113]

Didn't the Church get fined by the SEC for fraud?

Not fraud per se, but for filing "Misstated Forms" with the SEC.[114] In 2023, the SEC fined the Church and EPA a total of $5 million for "failing to file forms that would have disclosed the Church’s equity investments, and for instead filing forms for shell companies that obscured the Church’s portfolio and misstated Ensign Peak’s control over the Church’s investment decisions." [115]

So the Church and EPA were fined by the SEC for lying on a form?

Yes.

Was this $5 million fine a serious fine, or just a slap on the wrist?

The SEC doled out billions of dollars of fines in 2023 alone,[116] making the $5 million fine look small in comparison. However, the $5 million was significantly higher than any other reported fine for a Form 13F violation.[117]

Did the SEC file any criminal charges against the Church?

No.

Did the IRS file any charges against the Church related to Federal Tax law?

No.

Does the Church pay taxes?

Yes. The commercial enterprises owned by the Church operate under standard business tax obligations including corporate income taxes, property taxes, and sales taxes. [118]

Is the Church audited?

Yes. Every year, the Church releases the Church Auditing Department Report, which is the result of audits performed by an independent, but internal, auditing department.[119]

Is the Church financially transparent?

No, not really. The Church is required by law to disclose its financials in several countries, including Canada,[120] the United Kingdom,[121] and Australia[122], but not in its headquarters in Utah or in other countries without that requirement.[123]

Has the Church ever been financially transparent?

Yes, to varying degrees. Some early Church leaders, including Edward Partridge[BIO] and Brigham Young[BIO], gave sporadic financial reports.[124] Following the death of Brigham Young, John Taylor[BIO] proposed to make these reports annual, but ended the practice just six years after it began in 1884.[125] From 1915 to 1959, there was an annual finance disclosure made in the April General Conference made by a member of the First Presidency.[126]

Is the EPA fund taxed?

No. EPA is a nonprofit and religious organization,[127] defined as a "support organization" and "integrated auxiliary" to the Church.[128] This arrangement is legal and tax-exempt,[129] though some have critized the arrangement.[130]

Reportedly, EPA management fears negative consequences from government review or new legislation.[131] The Church has experienced targeted legislation that impacted its finances in the past, which may inform this fear.[132]

Who is the "whistleblower" David Nielsen? Who is his brother, Lars Nielsen?

David Nielsen worked at the investment company owned by the Church (EPA) as a portfolio manager from 2010 to 2019.[133] According to the Washington Post, in 2019 David began to "question aspects of [his] religion"[134] and began compiling a report with his twin brother Lars about Church finances.[135]

Lars had previously left the Church following a faith crisis in 2010.[136][137]

Why did David Nielson blow the whistle?

David Nielsen describes moral concern over the fund's purpose and management and frames this concern as the reason for his resignation from EPA and his whistleblowing message.[138] "My job is to tell the truth as fully and carefully as I can. The [Church], EPA, and their apologists may attack me, but they can’t attack the facts,” says David quoted in Letter to an IRS Director.[139]When asked why on 60 Minutes, David said, "This is too big a deal. This is important. This is not an example for how we should be."

Individuals whose tips to the IRS Whistleblower Office result in an IRS collection receive an award of between 15% and 30% of the collected money,[140] which some have suggested may be a factor in his decision to report.

Why did David quit working for the Church? Was he fired?

The separation was reportedly mutual.[141] David Nielsen left EPA after disagreements with his managers, including over business practices,[142] an NDA,[143] and whether he could continue employment without attending church or holding a temple recommend. [144]

What's in the fund? Where does the Church invest its money?

Church leaders and official statements have described church reserves as invested tithing and income invested in stocks and bonds; majority interests in taxable businesses; commercial, industrial, and residential property; and agricultural interests.[145][146]

EPA's managed funds are designed to be accessible and liquid.[147] According to alleged internal EPA slides leaked by David Nielsen, 75-85% of EPA's portfolio can be liquidated[148] in three months.[149]

Is the Church fund an endowment?

No. Traditionally, endowments are invested funds that generate constant income for the operation of an organization.[150] Unlike an endowment, EPA's investment returns are reinvested, added to the reserve, and generally aren't used to subsidize Church operations.[151]

Do the scriptures condemn wealth?

No, however they do warn against letting the pursuit of wealth become more important than your relationship with God and Jesus Christ.[152] The scriptures also condemn coveting wealth, as well as greed.[153]

Do other nonprofits or churches have billions of dollars?

Yes. Many charitable nonprofits have endowment funds[154] with billions of dollars, including many universities[155] and hospitals.[156] Some religious organizations have billions in investment portfolios, real estate, or art.[157] While other nonprofits or churches can have sizeable funds, the Church's financial situation is unique in many ways.[158](See table below).

Examples of Non-profit Endowments and Funds

Non-profit Entity | Endowment or Fund Size | Annual expense compared to reserve in years | Dollar per constituent |

The Church of Jesus Christ of Latter-day Saints | ~$100 billion | $6 billion, about 17 years. | $5,882 |

Harvard University[159] | $50.9 billion[160] | $5.4 billion, about 9 years.[161] | $114,314[162] |

Yale University[163] | $41.1 billion[164] | $4.65 billion, about 9 years.[165] | $255,349[166] |

Novo Nordisk Foundation[167] | $113.8 billion[168] | $26.45 billion, about 4 years.[169] | N/A[170] |

The Bill and Melinda Gates Foundation[171] | $69.0 billion[172] | 7.42 billion, about 9 years.[173] | N/A[174] |

Sri Venkateswara Swamy Temple[175] | $30 billion - alleged[176] | $297.78 million, about 100 years.[177] | $666[178] |

Sri Padmanabha Swamy Temple[179] | $20 billion - alleged[180] | $1.46 million, about 13,724 years.[181] | $1,148[182] |

Catholic Church in Germany[183] | $30.7 billion - alleged[184] | Unknown.[185] | $1,466[186] |

Catholic Church in Australia[187] | $30 billion - alleged[188] | Unknown.[189] | $5,910[190] |

The Church of England[191] | $14 billion (£10.4 billion)[192] | $1.32 billion (£980 million), about 11 years.[193] | $700[194] |

How much does the Church collect in tithing?

Probably around $7 billion a year[195], though it's not public information.[196] However, in some countries, the Church is required to publicly disclose the donations it receives.[197] This information can be used to estimate how much tithing the Church collects[198] (See table below).

Donations are the primary form of income for the Church.[199]

Reported and Estimated Tithing from a Selection of Countries

Country (membership numbers) | Tithing Amount and date (*estimated) |

Australia (154,595 members in 2021)[200] | $30 million USD in 2023.[201] |

Canada (199,054 members in 2021)[202] | $140.9 million USD in 2023. [203] |

United Kingdom (188,187 members in 2021)[204] | $79.98 million USD in 2023.[205] |

United States (6,721,032 members in 2021)[206] | $5.1 billion USD in 2021.*[207] |

Every other country (9,302,168 members in 2021)[208] | $1.7 billion USD in 2021.*[209] |

How did the Church accumulate so much money?

According to an alleged internal EPA slide from 2013, "over the past several years, approximately $1bn has been granted to EPA on an annual basis."[210] It appears this $1 billion granted to EPA is a yearly budget surplus.[211] This practice of considerable budget surplus being invested has been maintained by the Church since possibly the 1960s.[212] This practice would naturally result in a sizeable reserve fund.[213]

If the Church has so much money, why should I pay tithing?

Though tithing is about money and Church operation,[214] paying tithing is a personal act of faith to fulfill a commandment from God.[215] Church leaders describe tithing as being about sacrifice and trust in God, associated with promised blessings.[216] Church members pay tithing as a demonstration of faith, not as merely a financial transaction.[217][218] The Church maintains that tithing is a commandment from the Lord and that tithing donations help the Church fulfill its divine mission.[219]

Can I pay my tithing money directly to charities instead of the Church?

While donating to charities is a good thing to do, it is not the same thing as paying tithing.[220][221]

- Reuben

“I would rather the Church have more money than not enough. Look at Community of Christ over the past few decades--selling off assets like the Kirkland Temple, struggling to pay pension plans for church employees, and arguably even adjusting teachings in a quest to save themselves” - David

“I don’t have much problem with the Church holding billions as a rainy day fund or in a piggy bank of sorts through EPA, but I want to know why the EPA wanted to make shell companies in the first place; what is the advantage?” - Carlos M.

“We need even more savings and increased investments. This is good stewardship indeed. The brethren are doing a wonderful job—such a delight to have this high-quality leadership (even the highest).” - Luke

“This doesn’t bother me. There is no shady stuff from what I see, and it is just like the 7 years of plenty and 7 years of famine in Genesis. Also, the people who complain about this would do the exact thing they accuse the Church of doing.” - Jordan W.

“I’m gonna pay my tithing even harder now. Make it a trillion!”

about this topic

about this topic